Save Time

Do more in less

Prioritize

Bigger threats first

Take Action

Enforce automatically

Keep Track

Know your impact

Save Time

Do more in less

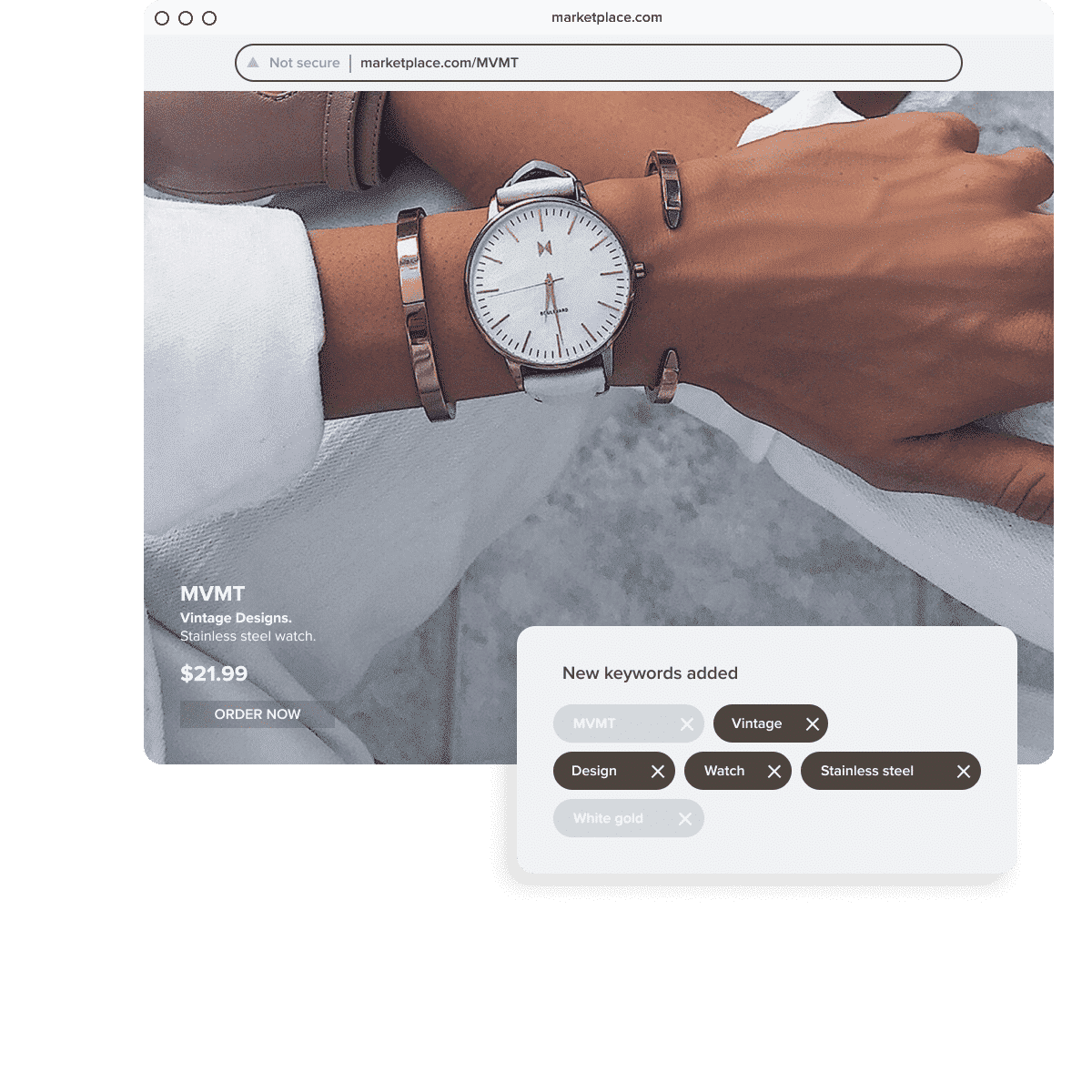

Let bot-powered search and advanced image recognition discover potential infringements for you

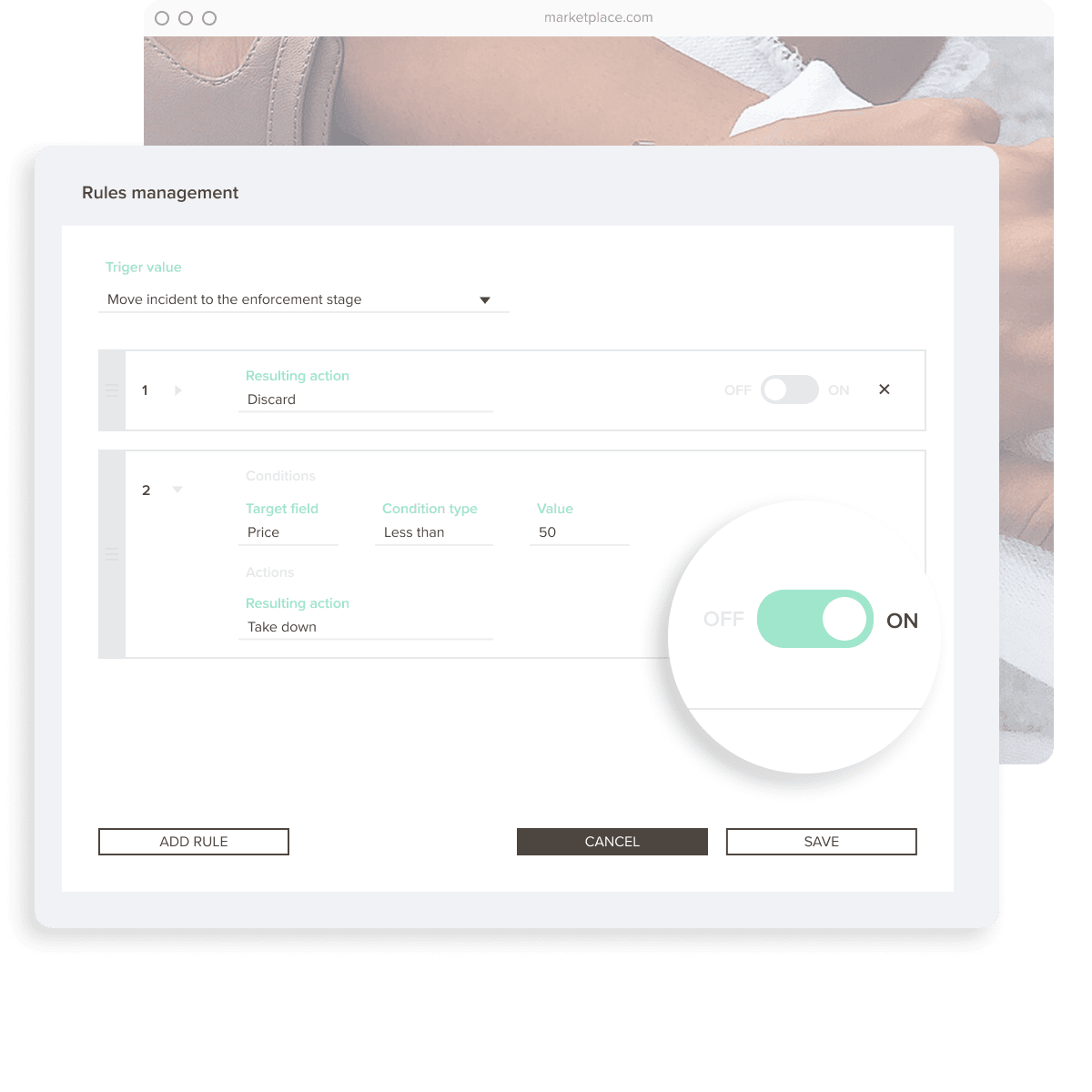

Leverage automation rules to review thousands of infringements faster or do manual checks on the brand protection solution dashboard

Boost your effectiveness with machine learning that incorporates patterns and keyword opportunities

Prioritize

Bigger threats first

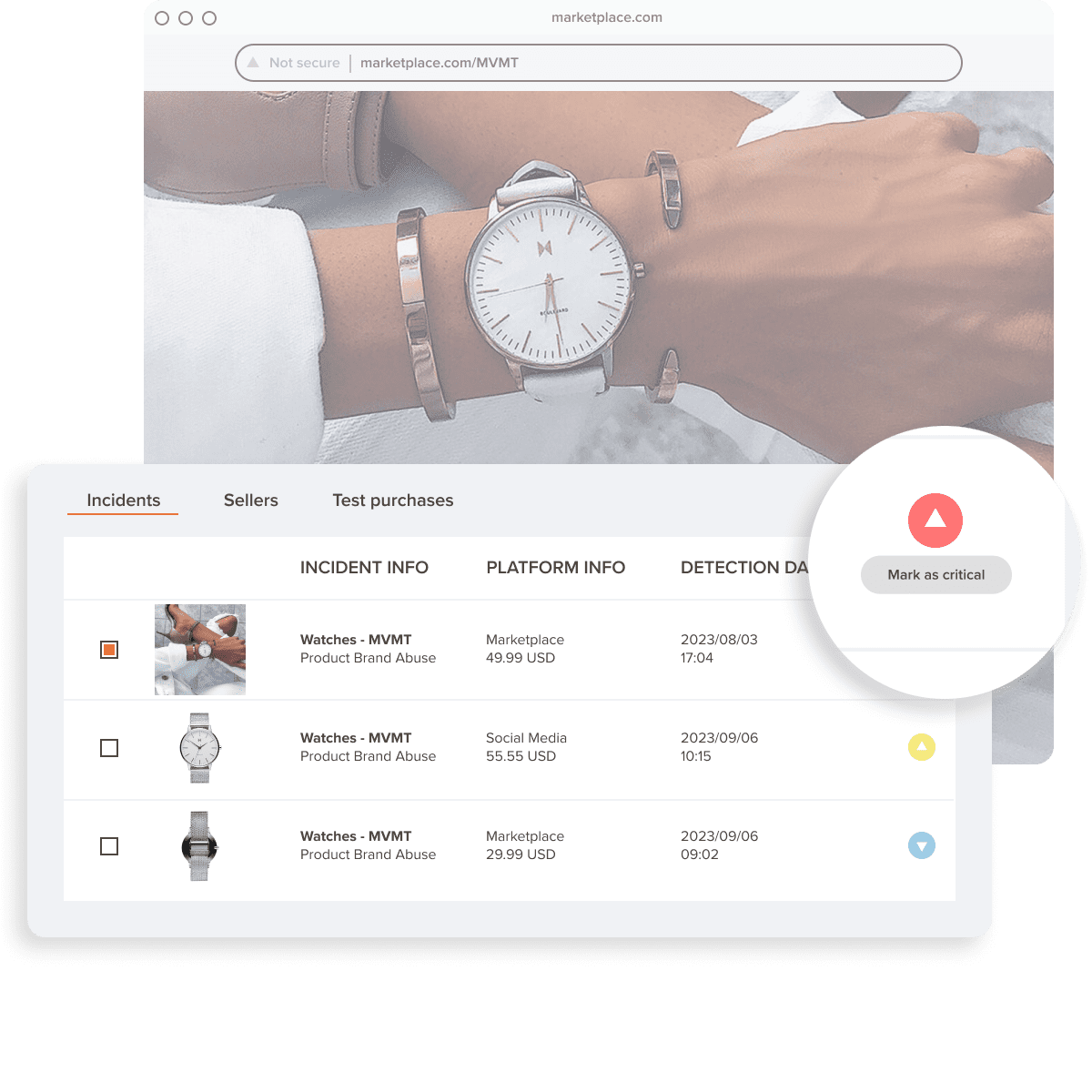

Define your unique prioritization criteria to process critical infringements faster

Use views and filters of a brand protection software to group IP infringements and act upon them at once

Leverage thousands of data points and discover repeat infringers’ identity with Seller Matching

Take Action

Enforce automatically

Define your unique prioritization criteria to process critical infringements faster

If you prefer, confirm or discard what listings to enforce in one click

Monitor listings and sellers after enforcement to avoid playing whack-a-mole

Keep Track

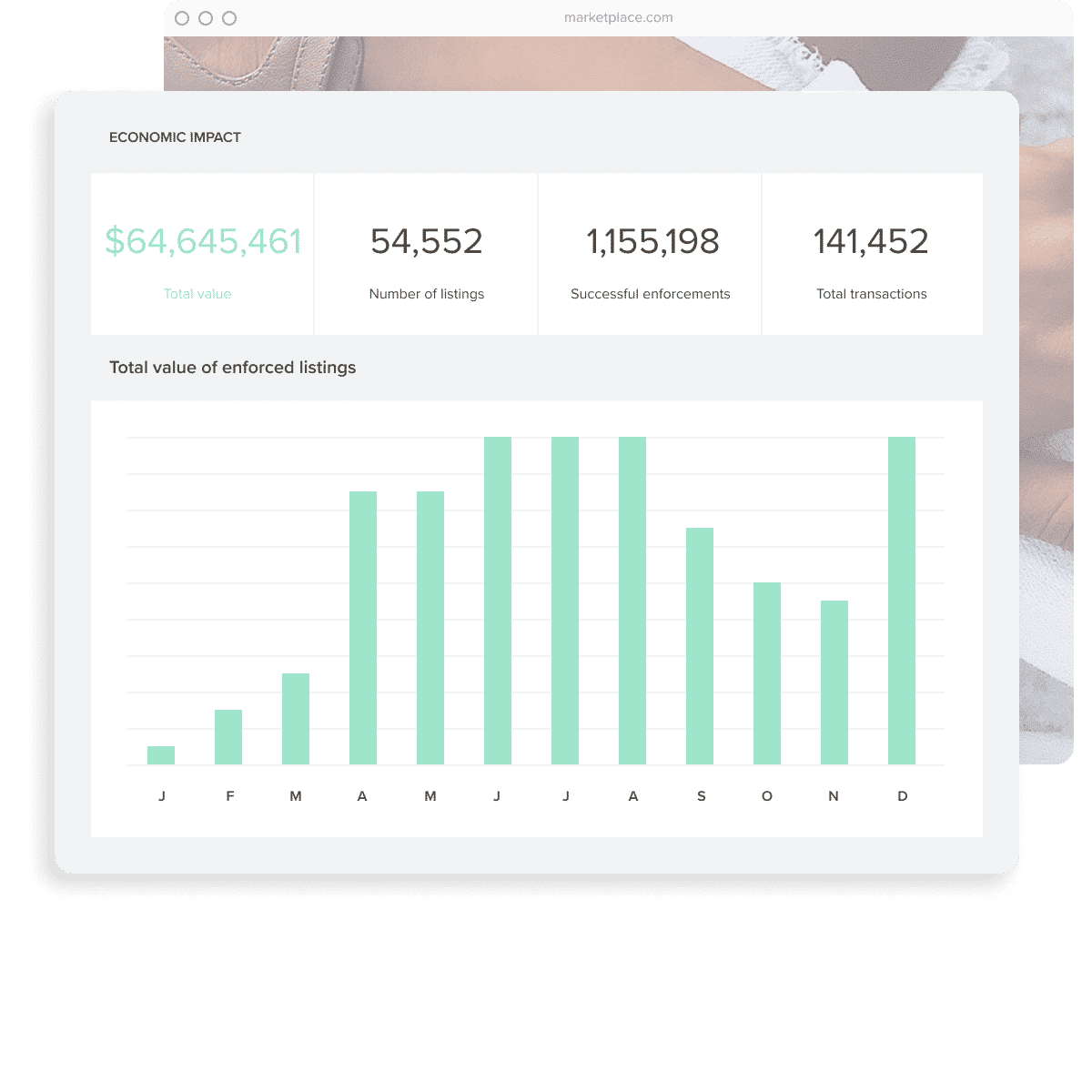

Know your impact

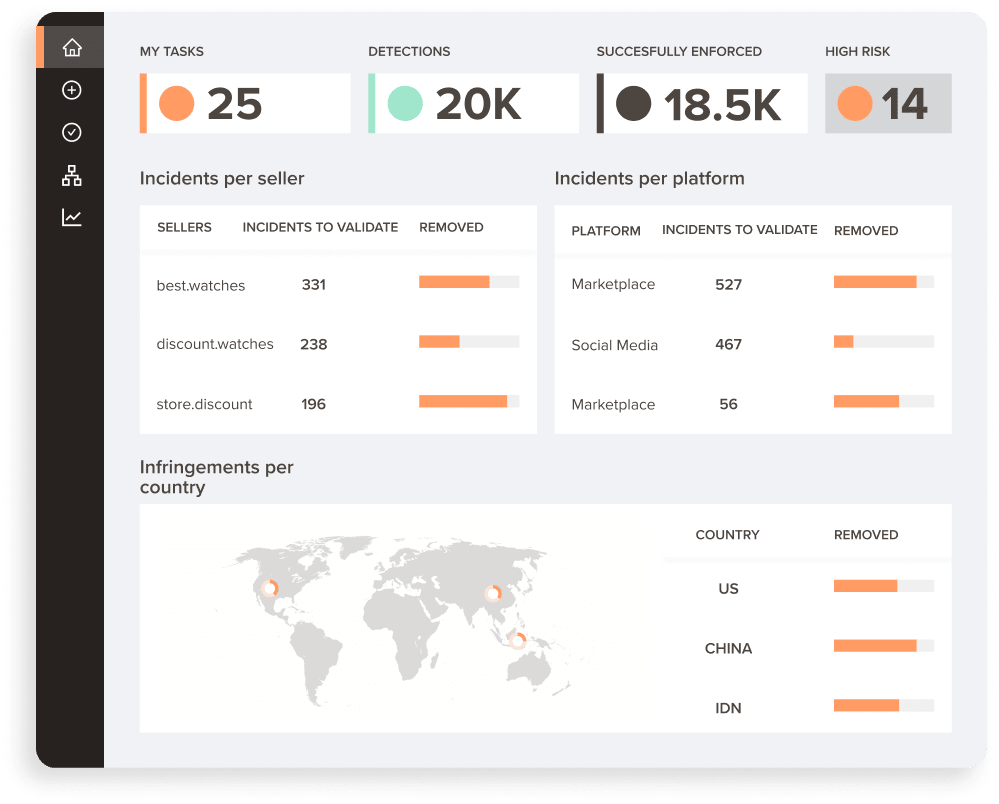

Estimate the economic impact of your brand protection actions

Leverage real-time data and deep analysis with personalized brand protection solution’s dashboards

Consume data in the way that suits you best by exporting or connecting with BI tools via API

Detect

Widen the net by looking for infringements with bot powered search through text and images

Validate

Filter in real time leveraging image recognition and logic rules to discard or confirm counterfeits or decide one by one

Cluster

Get to the source matching hundreds of seller data points to uncover repeat infringers’s identity

Remove

Enforce 24/7 by requesting takedowns automatically from brand protection tool for validated infringements

Evan Feldstein, Foreo

Lawyers & General Counsel

Red Points’ brand protection services provide the legal expertise and proactive measures needed to combat unauthorized domain usage, preventing potential legal disputes and costly litigation.

Jess Dorward, The 5th

Marketing teams

Our brand protection software provides marketing teams with comprehensive oversight of their brand’s online presence, increasing trust and engagement by eliminating counterfeits and online scams, while ensuring secure and authentic digital interaction between brands and their customers.

Pete Fenlon, Catan

C-suite executives

Red Points’ brand protection solutions are a strategic choice for executives, as they help maintain brand integrity, minimize risks, and ensure that the organization’s digital footprint remains a beacon of trust and authenticity.

Josh L. General

Manager

Fantastic option for fighting copies of products!

Overall

Not only does it give us the confidence that copies of our products are being found and dealt with worldwide, but it has also enhanced our relationships with our distributors.

Pros

Red Points online dashboard is very simple to use and has strong back-end reporting. It is a very quick process to check daily and approve or remove potential copies of our products that they find. The customer service team is excellent even though they are in Europe and we are in New Zealand – has never been a problem for us. It has definitely helped us in our fight against copies worldwide and is great value for money….FAR cheaper than a lawyer!

Reasons for Switching to Red Points:

Cost initially. However over time we have seen Red Points has a fair quicker and greater reach than lawyers do.

Joe H.

Marketing & Engagement officer

Well-designed software that works with excellent customer support!

What do you like best?

The UI is clear, simple and well laid out so it’s easy to navigate. I was able to learn the software very quickly as well as roll out teaching to others with no issues. The algorithm really captured a great deal of matches after a short learning period and I was able to work through a large number of items easily thanks to the thorough setup. The customer support is also excellent, communicative and very helpful so we are able to get the most out of Redpoints.

Tobias B.

IPR Coordinator

Efficient removal of infringing listings!

What do you like best?

Red Points quickly and independently scans several platforms for infringing listings. What used to be a days work to search trough the platforms and report them is now done in minutes. The customer support is also great.

What is brand protection software?

A brand protection software enables businesses to remove counterfeit products, delete impersonated profiles and websites, eliminate online piracy, claim/monetize content rights, stop credential reselling, and keep track of sellers in real-time to understand their online presence.

How are brands protected?

To protect themselves from infringers, brands can implement a number of strategies, both offline and online. This includes: registering your IP, educating your consumers, having a strong social media presence, and proactively fighting bad actors using technology like brand protection tools to streamline the process. They can also work with online brand protection companies to automatically monitor and takedown infringing assets online.

What are online brand protection solutions?

Online brand protection minimizes online threats and protects your intellectual property. Anytime, anywhere. Having effective online brand protection solutions and tools safeguards your brand’s revenue, profitability, reputation, and customer service.

Why is brand protection software important?

Nowadays, most customers shop online. As a result, the e-commerce space has become more powerful than ever before. While this presents a big opportunity for brands, bad actors are also actively cashing in on this trend by hijacking your intellectual property and misleading your customers.

Bad actors target every category you can think of, from pharmaceutical products to software and even wind turbine manufacturers. They use a range of tactics from creating fake websites, copying your social media account, or even creating and selling fake copies of your products. This can in turn lead unsuspecting customers into buying fakes or worse providing their personal information. The worst part of it all is that in most cases, the legitmate brands often tend to get blamed for it.

As a result, brand protection solutions have become a crucial component of every brand’s overall business plan to safeguard its reputation and prevent customers from being misled into buying unsafe or low-quality products.

When done properly, having a robust brand protection strategy and brand protection tools can not only have a direct impact on customer satisfaction but it can also positively impact your bottom line.

What are the benefits of brand protection software?

The benefits of implementing a brand protection software are countless when it comes to protecting your brand online and at scale. It can be a real game changer. In addition to greatly reducing cost and time required to protect your brand, online brand protection solutions also give you greater visibility into your online assets.

Beyond the massive amount of time brands waste dealing with bad actors manually every year, it goes without saying that businesses without a brand protection strategy and brand protection tools are more vulnerable to unfair competition. When left unchecked, scammers, fakes, and frauds copying your brand and stealing your revenue will negatively impact your bottom line whilst unauthorized sellers will erode your distribution networks.

As a matter of fact, since leading kitchen manufacturer Lékué, implemented Red Points’ brand protection software a year ago, the online sales of their best sellers have increased by 60%.

What should a brand protection plan cover?

When it comes to looking for brand protection companies and services, it’s important to compare apples to apples. In other words, be aware of all brand protection services included as well as the kinds of results you can expect after implementing brand protection solutions.

For example, two brand protection software may crawl the internet automatically to detect infringement of your brand, but one may only use keywords whilst the other incorporates advanced image recognition to discover potential infringements for you. In this case, you’d get more protection for your dollar with the second option.

While many companies can make use of a brand protection software, not all require the same type or level of protection. That´s why it’s important to consider how online brand protection companies charge for the program and what’s included in the cost. Does your provider offer a flat fee or do you pay per takedown? Can you protect multiple trademarks at once? Will it incur additional costs? Do you need to pay extra for different types of infringements?

Here are some other important features brand protection solutions should include:

1. Instant takedown of the infringements

2. Global IPR protection and coverage

3. Real-time monitoring across various channels such as marketplaces, social media, websites, domains, search engines, mobile apps, video platforms, cyberlockers

4. Multi-language protection

5. A team of experts to help you make informed decisions

Red Points Brand Protection software includes multiple pricing levels to help protect companies of different sizes and stages. If you’re tired of playing whack-a-mole with infringements, get in touch with us for a 10-minute demo call to see the pricing and online brand protection tools that are available to you.